Personal Wealth Services For Individuals And Families

✨ SIP is wealth-building for those who had to build themselves first. Founded by Anu Rames, who’s lived the gap between power and potential, SIP serves those who are now ready to lead.

💭 If you grew up restricted – by awareness, access, survival – you felt money differently. Because wealth isn’t just about discipline. Its also about permission. But your instinct to steward, to grow, to provide? It never left. It waited.

🌱 At SIP, you don’t just grow portfolios. You grow agency. Because investing isn’t just about markets. It’s about healing – with strategy.

Frequently Asked Questions

Find answers to common questions about services offered.

Yes. SIP operates as a fee-only, fiduciary advisory firm. That means we act in your best interest—always. We receive no commissions, kickbacks, or product-based incentives.

SIP offers independent investment reviews for those seeking a trusted third-party perspective. Whether you’re looking to confirm you’re on the right track or want a deeper understanding of your current strategy, SIP provides clear, objective insights—with no sales agenda, product commissions, or hidden incentives.

If desired, SIP can also manage a dedicated sleeve of your portfolio aligned with your specific goals – without needing to replace your primary advisor.

Yes. We work with clients at all levels of net worth and investing experience.

SIP offers financial guidance for all levels of wealth—no minimum asset size is required. Services are designed to support clients at various stages, from early portfolio builders to experienced investors. The firm does NOT specialize in debt management or credit repair and may not be the right fit for those focused primarily on resolving debt issues. The focus is on long-term investment strategy.

– Ongoing investment management

– Project-based financial planning

– Retirement readiness

– Tax-aware portfolio construction

– Values aligned investing

SIP is a fee-only advisory firm. Depending on the type of engagement, costs may take the form of a percentage of assets under management (AUM), a flat project fee, or an hourly rate. There are no product sales, commissions, or hidden costs. All costs are clearly outlined in advance and based on the scope of services provided. Clients may also see standard third-party costs—such as custodian fees or fund-level expenses (like mutual fund or ETF fees)—which are separate from SIP and not paid to the firm.

What Can You Expect?

Great wealth advice starts with your clarity. And your financial plans must go deeper than spreadsheets.

At SIP, your plan begins with understanding what safety looks like—not just on paper, but in real life. For example, how much cash or liquid assets creates a sense of security? What number brings calm—not because it’s “correct,” but because it feels right?

This kind of clarity is foundational. Once it’s known, the rest can be designed with intention.

This is planning that holds space for both financial growth and emotional truth – aligned with personal goals, values, and timelines.

Not just wealth creation, but wealth integration—so money can finally feel like it belongs.

Anu Rames, Founder & Managing Principal of SIP, is an investment professional trusted by both institutions and individuals navigating the question “What’s enough – and what’s next?”

With nearly two decades of investing experience at global firms like BNP Paribas Asset Management, Liberty Mutual Investments, Boston Trust Walden etc., Anu brings institutional rigor to human-centered outcomes. At Liberty Mutual, she served on the 401(k) Investment Committee, stewarding retirement assets for 72,000+ participants.

Anu holds an MBA from Babson College and an engineering degree from Calicut University.

Whether you’re building a platform, a portfolio, or a second act – Anu can help you launch with clarity and conviction.

Curious about next steps?

Exploring your financial future with a third-party advisor can feel like a big step—but it doesn’t have to be complicated. It starts with a simple conversation. Share your goals, ask your questions, and see whether this approach aligns with what matters most to you.

First, book a short complimentary call to get clarity on your goals and see if there’s a path forward together. Once the decision is made to move forward with SIP, the next steps are straightforward. The first step is signing the advisory agreement, which outlines the services, responsibilities, and fees. Then, investment accounts are opened in your name—typically at Charles Schwab. Funds or existing investments can be transferred into those accounts.

From there, the investment strategy is reviewed and confirmed based on your goals, preferences, and any restrictions you’ve shared. Once everything is in place, the portfolio is built and actively managed. Ongoing check-ins and clear communication help ensure everything stays aligned over time.

SIP has permission to manage the investments inside your account—but never to withdraw your money or move it elsewhere. The account stays in your name, at a third-party custodian like Charles Schwab, and you can see everything at any time.

Need More Help?

Explore Latest Thoughts

The almost weekly blog that decodes the drama—with wit, strategy, and a sharp pulse on market moves and headline chaos.

Money Moves for a Midlife Career Pivot

If you’re in your 40s or 50s and thinking about a career change, you’re not alone. Midlife has a way of sharpening our vision. You start seeing what’s no longer working — the burnout, the boredom, the quiet feeling that maybe you’ve outgrown the box you spent decades building.

And then the question hits: Can I even afford to change direction now?

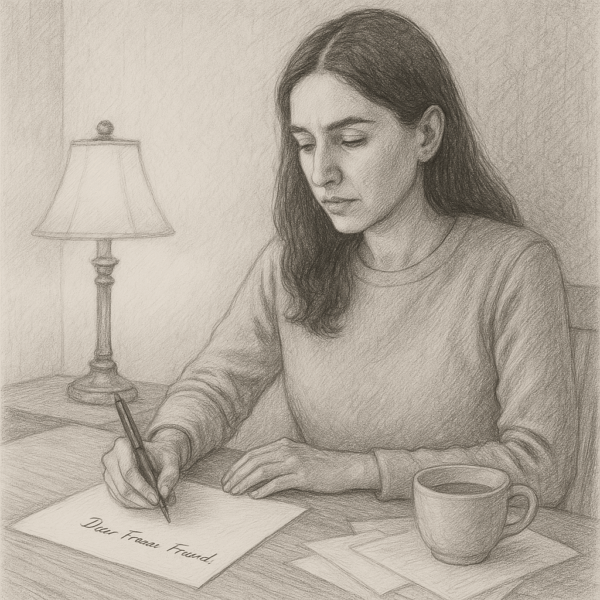

Dear Frozen Friend : How Do You Stay Financially Grounded During a Crisis?

By reframing your fear into activation, and building adaptive financial systems! Do that instead of freezing in response to shifting markets, war, and policy shocks. You don’t need to predict the future—you need a personal protocol that keeps you grounded when the world flexes.

Market Timing & Lazy Narratives

𝗦𝗵𝗼𝘂𝗹𝗱 𝘆𝗼𝘂 𝘁𝗶𝗺𝗲 𝘁𝗵𝗲 𝗺𝗮𝗿𝗸𝗲𝘁?

𝗢𝗳 𝗰𝗼𝘂𝗿𝘀𝗲 𝗻𝗼𝘁. But you better know how to spot a lazy narrative when you see one. Here’s a classic example: “Miss the 10 best days in the market and you lose 50%+ of your returns!” Sounds terrifying. Convincing. Maybe even scientific.

Until you dig deeper.

SORR – Sequence of Returns Risks

𝙎𝙊𝙍𝙍: Sequence of Returns Risk . The market’s way of whispering, “Sorry… your averages matter less.”

You spend years building a retirement portfolio. You watch the averages. You think you’re ready. And then—𝘽𝘼𝙈—a crash hits right as you enter retirement.